Meta Description:

Learn the fundamentals of Forex trading with FxGuruz.com — your trusted Forex guide. Understand currency pairs, leverage, brokers, and risk management in this complete beginner’s guide.

What is Forex Trading?

The foreign exchange market, also known as Forex or FX, is the largest financial market in the world — where currencies are traded globally. Every day, more than $7 trillion moves through this market, making it bigger than all stock markets combined.

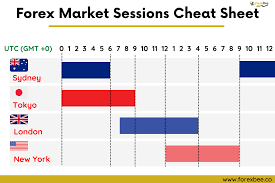

Forex trading allows individuals, banks, and institutions to buy and sell currencies 24 hours a day, five days a week. Traders profit from the changes in exchange rates between different currencies.

How Forex Works

In Forex, currencies are traded in pairs — for example:

-

EUR/USD (Euro vs. US Dollar)

-

GBP/JPY (British Pound vs. Japanese Yen)

-

USD/BDT (US Dollar vs. Bangladeshi Taka)

When you trade a pair, you are buying one currency and selling another at the same time.

If you expect the Euro to strengthen against the Dollar, you buy EUR/USD.

If you expect it to weaken, you sell EUR/USD.

Understanding Currency Pairs

Each Forex pair has two parts:

-

Base currency – the first currency in the pair

-

Quote currency – the second currency

For example, in EUR/USD = 1.1000, one Euro equals 1.10 U.S. Dollars.

If the price increases to 1.1200, the Euro has strengthened; if it drops, the Euro has weakened.

What Moves the Forex Market?

Currency prices are influenced by many global factors. The most common include:

-

Interest rates – Higher rates often attract foreign investment.

-

Economic data – Reports like GDP, inflation, and unemployment rates.

-

Political events – Elections, policies, and conflicts affect stability.

-

Market sentiment – Trader confidence and expectations.

Choosing a Forex Broker

To start trading, you’ll need a Forex broker — a company that connects you to the market via platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

A good broker offers:

-

Tight spreads

-

Fast execution

-

Transparent regulation

-

Reliable customer support

👉 Visit FxGuruz.com for recommended regulated Forex brokers trusted by global traders.

Leverage and Margin Explained

Forex trading allows you to use leverage, which means you can control large positions with a small deposit.

For example, 1:100 leverage lets you trade $10,000 with just $100.

However, leverage increases both potential profits and risks. Always use it wisely, as even small price movements can cause significant gains or losses.

Forex Trading Styles

There’s no one-size-fits-all strategy in Forex. Popular trading styles include:

-

Scalping: Short trades lasting seconds or minutes.

-

Day Trading: Open and close all positions within the same day.

-

Swing Trading: Hold trades for several days.

-

Position Trading: Long-term investing based on market fundamentals.

Risk Management in Forex

Successful traders always focus on protecting their capital.

Follow these golden rules:

-

Never risk more than 2% of your account per trade.

-

Use Stop Loss orders to limit losses.

-

Avoid over-leveraging.

-

Keep emotions out of trading.

-

Maintain a trading journal to track performance.

Why Trade Forex?

Forex offers many unique benefits:

-

✅ 24/5 market access

-

✅ High liquidity

-

✅ Low starting capital

-

✅ Opportunities in both rising and falling markets

It’s a flexible and global market where anyone can participate — from home, on mobile, or through automated systems.

Final Thoughts

Forex trading can open doors to financial independence — but success doesn’t happen overnight.

At FxGuruz.com, we believe knowledge is your most powerful tool.

Start by learning, practice with a demo account, and trade responsibly.

💡 FxGuruz.com – Learn. Trade. Grow.

Your trusted partner for Forex education, broker reviews, and daily trading insights.